Building Tomorrow’s

Leaders Together

We support ambitious entrepreneurs in creating leading platforms — built to become market champions.

Vision

At Maupiti Partners, we put our expertise at the service of executives to help them move faster and more effectively, maximizing the success of every transaction.

Our role: to be their long-term partner, so they can focus on what truly matters — steering and growing their business.

Values

Commitment

We build exclusive, long-term relationships of trust with our clients, putting alignment at the heart of every engagement.

Independence

We cultivate exclusive, long-term relationships built on trust and integrity. Alignment of interests with our clients is not just a principle — it’s our compass.

Excellence

Excellence lies at the heart of everything we do. Our teams — driven by the constant involvement of our senior bankers — deliver flawless execution combining proximity, precision, and world-class standards.

Loyalty

We stand alongside our clients for the long haul, even in the most complex and uncertain situations. Their project becomes ours, and our loyalty never wavers.

Services

Buy & Build Strategy Review

Validation of growth-by-acquisition priorities and creation of a tailored SME selection matrix for each client.

Identification of Build-Up Opportunities

Selection of potential targets in collaboration with management, taking into account strategic priorities.

Development of a Tailored Playbook

Creation of all marketing and positioning materials to maximize the success of target approaches.

Target Outreach

Implementation of a proactive and confidential approach to engage with the most relevant potential targets.

M&A Process Supervision

Coordination of due diligence teams and negotiation of financial and legal terms of acquisitions.

Active Pipeline Monitoring

Capitalizing on identified opportunities to ensure they are effectively reflected in the company’s valuation at exit.

Peter Drucker“The best way to predict the future is to create it.”

Clients

CEOs

Entrepreneurs

Investment

funds

Business Services

Energy

Real Estate

Industry

Healthcare

Financial Services

Reallocating

Internal Resources

Maximizing

Conversion Rates

Speed and Execution

Quality

Buy & Build

Value Creation

at Exit

Team

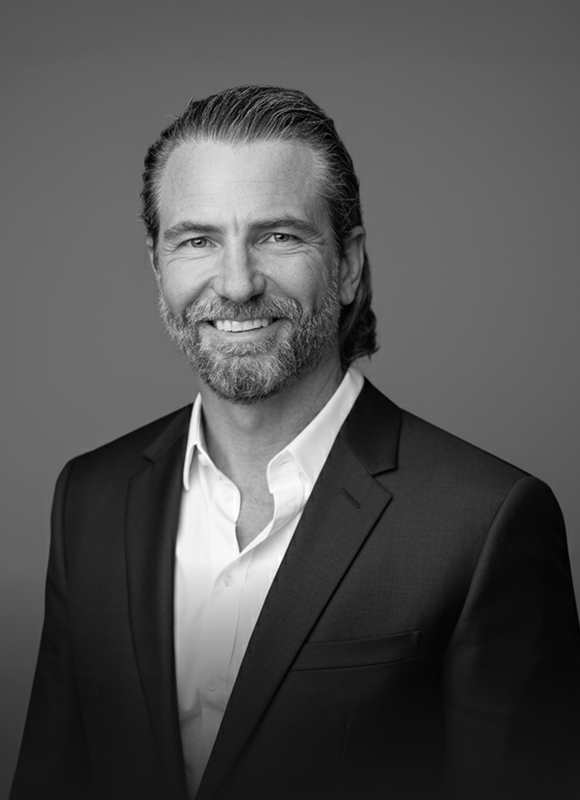

Founder of Maupiti Partners, Olivier brings over 15 years of M&A experience from Lazard and Rothschild & Co.

He also served as CEO and co-founder of Boks, an innovative last-mile logistics startup.

Throughout his career, he has advised over 25 midcap and large-cap transactions in the defense, industry, energy, and logistics sectors, both in France and internationally.

Olivier is a graduate of EDHEC Business School.

Olivier de Rodellec

Managing Partner

Leïla joined Maupiti Partners in 2025 as Principal.

She began her career in M&A at AP Management, then in Private Equity at Isatis Capital, before joining Financière de Courcelles as Associate in 2022.

She has advised on transactions across TMT, healthcare, and industrial sectors.

Leïla is a graduate of emlyon business school.

Leïla Gley

Principal

Former CEO of the ETANCO Group, Ronan led the company for 20 years — 15 of which under LBO ownership.

At 30, he was among the youngest midcap LBO CEOs in France.

He successfully completed three LBOs (IK, 3i/Five Arrows, ICG), followed by a strategic sale to a NYSE-listed U.S. company.

Ronan is also the founder and president of the LBO Club, France’s first network of LBO business leaders.

Ronan Lebraut

Senior Advisor

A specialist in LBO environments, Alexis spent nearly 20 years in management, including 10 years as CFO of the ETANCO Group.

During that time, he led two LBOs and one industrial sale, while executing numerous external growth operations in France and Europe.

Alexis is currently CFO of the LBO Club.

Alexis Legrix de La Salle

Senior Advisor